- Blog

- How to Import a Car to Moldova

How to Import a Car to Moldova

Learn the documents, taxes, and steps required to import used cars to Moldova. Find out how duties work and what businesses need before importing a vehicle.

Before you start importing used cars to Moldova, you have to familiarize yourself with the documents you’ll need and the processes to follow.

Fortunately for car traders, Moldova doesn’t have complicated import regulations, meaning that you can easily import vehicles of any age or fuel type.

The process is straightforward, but costs vary depending on the car’s age and emissions. Here’s everything you should know before bringing a used car into Moldova.

Understanding Moldovan car import regulations

While there was a ban on importing cars older than 10 years, that’s no longer in effect since 2021.

Now you can bring in cars of any age and fuel type, but duties and excise rise with age, engine size, and emissions, so older or large-engine cars will cost more at the border.

With that note in mind, you’re ready to start gathering import documentation.

Documentation for importing a vehicle to Moldova as a business

Take a look at the list of documents you’ll need during import.

► Vehicle purchase invoice

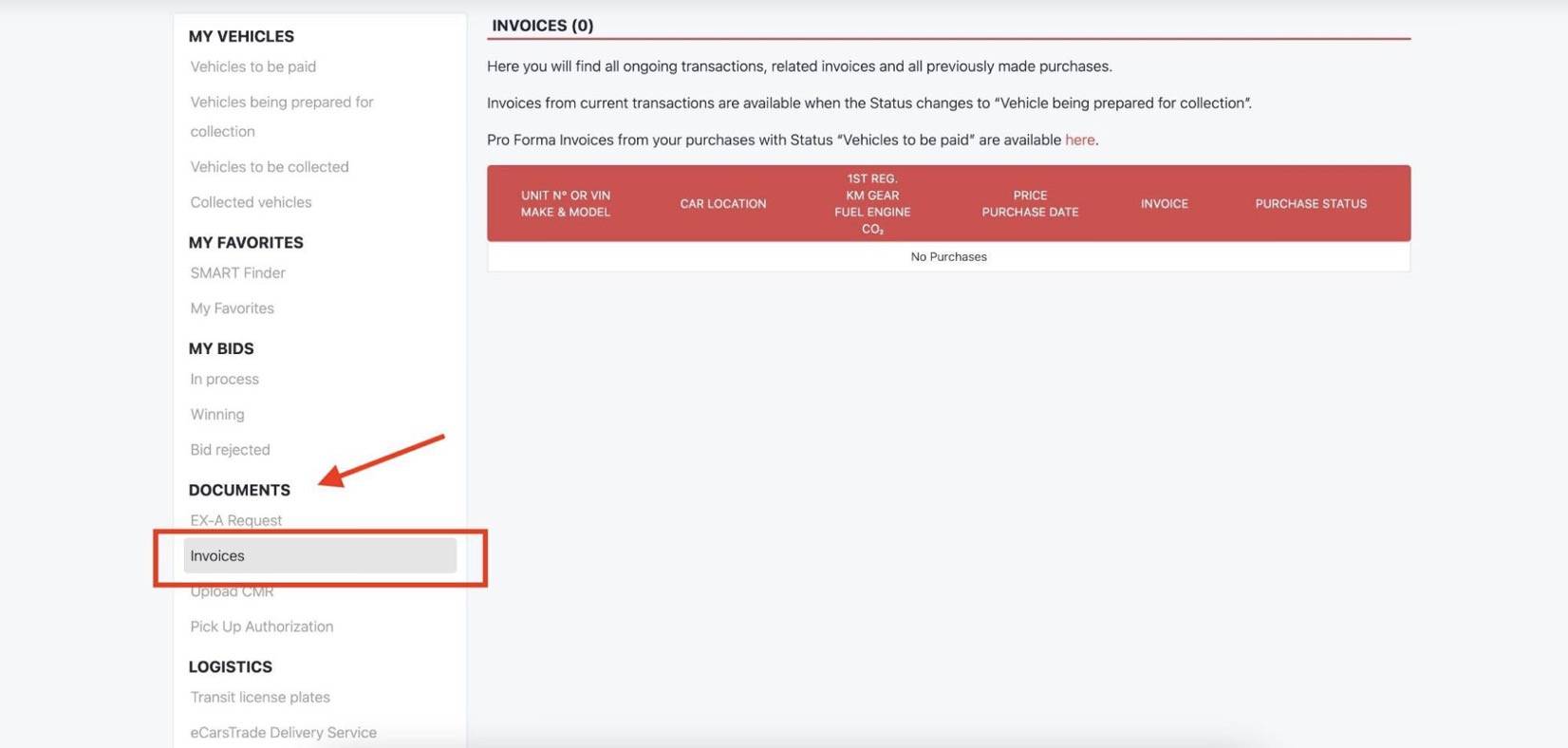

The first document you’ll need is the vehicle purchase invoice, which proves the sale and the car’s customs value.

It should show buyer and seller details, VIN, make and model, price and currency. If you’ve bought a car through eCarsTrade, you can access the invoice through your Personal Page.

► Original registration papers

These documents prove the car’s previous registration and ownership. Customs will check them when you declare the vehicle, and you’ll also need them later to register it in Moldova.

All cars on eCarsTrade are sold with the original registration papers included.

► Customs declaration

Next, you’ll have to prepare a customs declaration and present it to the Moldovan Customs Service.

You can access the electronic customs declaration service here.

► Consignment note

If you’re shipping the car to Moldova with a transport company, you’ll need the consignment note, also called CMR.

It confirms who sent and who receives the vehicle, along with the route and vehicle details, so customs can match the shipment with your invoice. If you’re driving the car yourself, you don’t need a CMR.

► Certificate of Origin

This document shows where the car was originally produced. This document is not necessary for the import process, but it’s worth getting so you can claim preferential origin.

Moldova grants reductions of import duty when the car qualifies under trade agreements with partners like the EU or CEFTA countries.

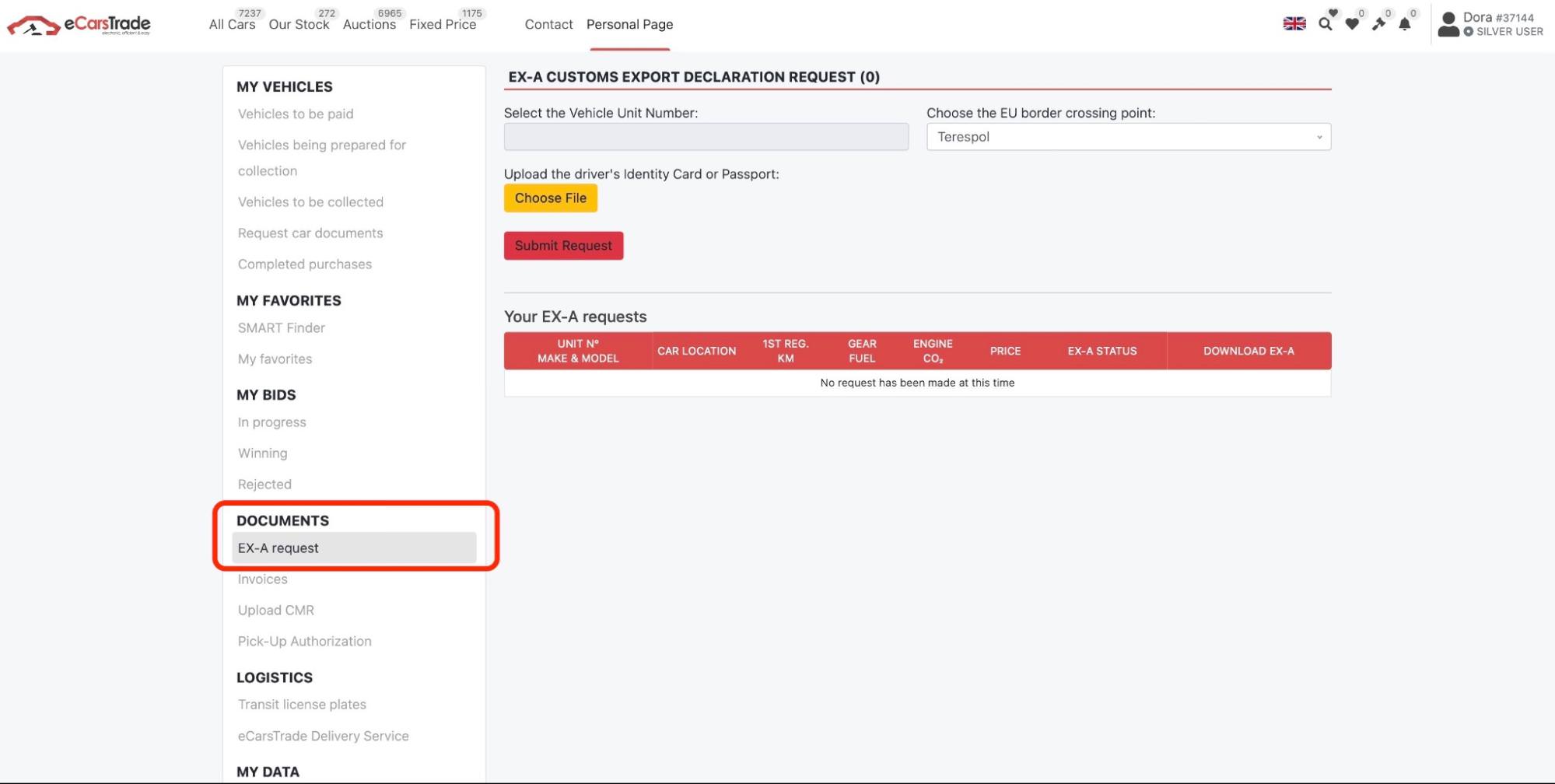

► EX-A

The EX-A export declaration proves that the car has officially left the EU. You’ll need this document to end the process of exporting from the EU, and to claim back VAT.

The EX-A contains the Movement Reference Number (MRN), which you can use to track the car’s export status online and confirm when it has officially left the EU.

► Registration documents for the businesses

If you’re importing as a company, you’ll need to show proof of business registration in Moldova.

Taxes when importing a car to Moldova

When you bring a used car into Moldova as a business, you’ll face multiple duties and taxes. Here’s what they are.

Customs duty

The first tax you’ll come across is customs duty. It’s not paid at a fixed rate, but it depends on the car’s value and where it comes from.

Customs can charge it as a percentage of the car’s customs value, as a fixed amount per unit, or sometimes as both.

If the car comes from a country that has a trade deal with Moldova, and if you have the Certificate of Origin to prove it, you might pay a lower duty.

Excise duty

Every imported car is charged an excise duty. The amount depends on the car’s engine type, engine size, and age.

Moldova offers incentives for low-emission vehicles:

- Electric cars: no excise duty

- Plug-in hybrids: 50% reduction

- Standard hybrids: 25% reduction

VAT

You’ll also pay Moldovan VAT at import, which is 20% of the car’s value. Customs calculates it on the car’s customs value plus any customs and excise duty.

If your company is VAT-registered in Moldova, you can deduct that import VAT in your return.

On eCarsTrade invoices you’ll see two VAT schemes:

- Standard scheme: the exporter issues an invoice without foreign VAT. You pay 20% Moldovan import VAT and later deduct it.

- Margin scheme: the seller charges VAT only on their profit margin in their country. You can’t deduct that foreign VAT. You still pay 20% Moldovan import VAT at the border and can deduct that Moldovan VAT in your return.

Whether a car is sold under the standard or margin scheme is marked in every car listing on eCarsTrade, so you can easily check the VAT scheme before bidding and plan your total costs and tax deductions in advance.

Step-by-step process - from purchasing a car to importing it to Moldova

Now that you know what documents to prepare and what taxes to expect, let’s look at the process of buying a used car and importing it to Moldova.

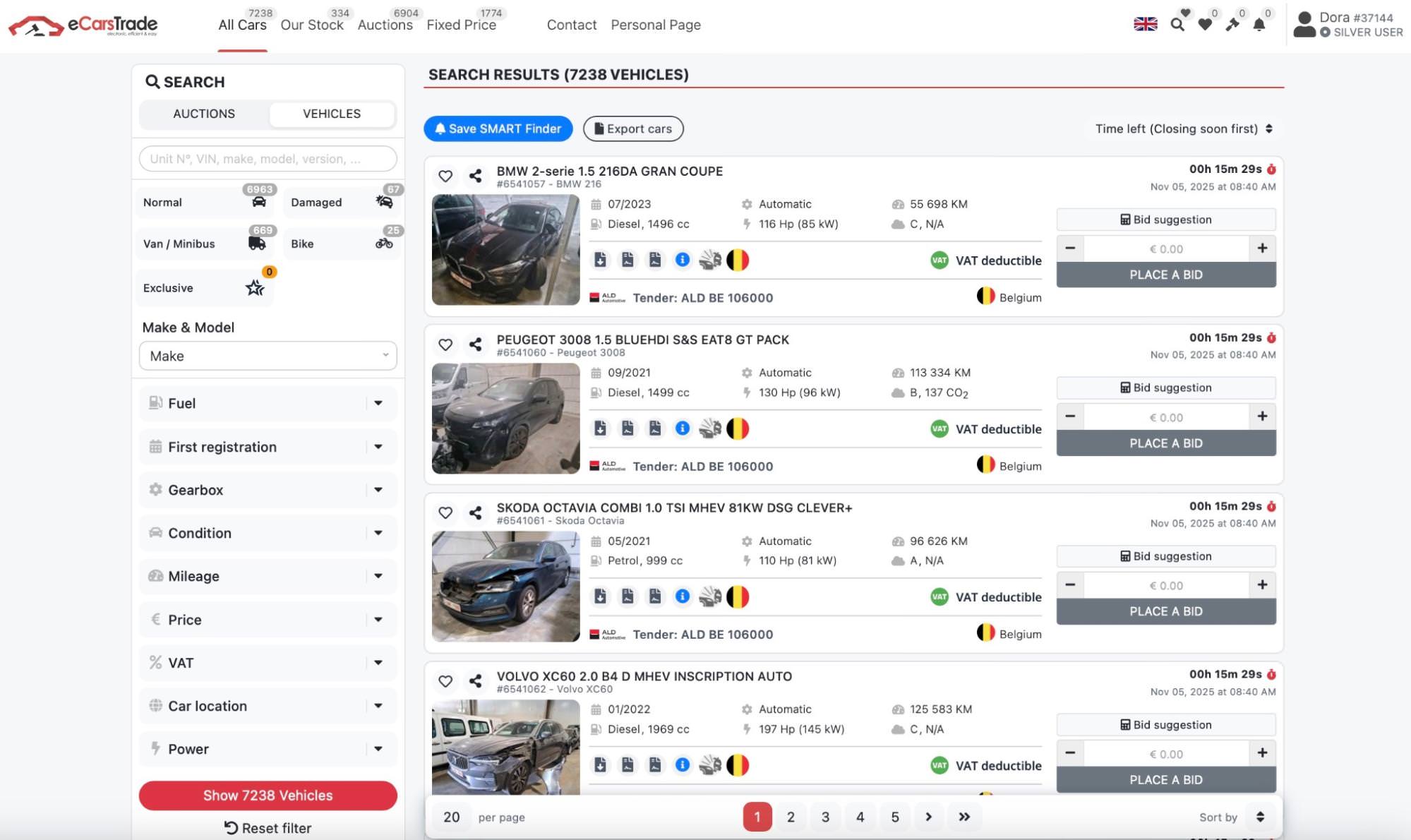

1. Choose and purchase the car

The process starts with selecting the right cars that your dealership can import and resell quickly. On eCarsTrade, you can use filters to find cars that fit your market best.

You can filter by brand, first registration year, VAT scheme, and more to quickly spot vehicles that match your and your buyers’ needs.

After you’ve won an auction, you can pay directly within the platform, and the car is yours.

At this step, you’ll also pay a VAT deposit if the car is sold under the standard VAT scheme.

The deposit equals the seller’s local VAT rate (for example, 19% if you’re buying from a German seller) and it will be refunded to you once you prove that the car has left the EU.

2. Arrange transport

After purchase, you can book delivery directly through eCarsTrade’s Delivery service. You’ll get a quote and choose the delivery address, and eCarsTrade coordinates the carrier and CMR.

3. Request the EX-A declaration

You’ll need to request the EX-A because you’ll need it for your VAT refund, and for completing the process of exporting the car from the EU.

Visit the Documents section on your eCarsTrade profile, and you’ll be able to request the EX-A there.

You will need to provide us with the border crossing point where the car is exiting the EU.

4. Claim your EU VAT refund

Once the car leaves the EU, you can claim back the VAT you paid as a deposit to the seller. You can track the car’s export status using the MRN number on the MRN Follow-Up page.

If you bought the car from, for example, a German seller, you paid a 19% VAT deposit when purchasing.

After the export is confirmed, send the seller the proof of export. They’ll then refund the VAT to your account.

5. Present documents to Moldovan Customs

Bring your paperwork together and declare the car. You’ll need:

- Vehicle purchase invoice

- Original registration papers

- Customs declaration

- CMR if the car was shipped

- EX-A export declaration

- Certificate of Origin if you’re claiming preferential duty

- Proof of export (MRN or export confirmation)

Customs will check the documents and calculate duty, excise, and VAT.

6. Pay VAT

Pay the taxes that customs calculated. If your company is VAT-registered in Moldova, you can deduct the import VAT in your return.

7. Register the car

After you clear customs, take your vehicle documents to register the car in Moldova. Complete technical inspection if required, arrange insurance, pay the registration fees, and collect the car’s registration plates.

Get to know the Moldovan used car market

As of 2025, the Moldovan car market is looking promising.

In August 2025, new car sales increased by more than 16% compared to last year, which shows that demand is recovering after a few slow years. The top-selling models currently include:

- Dacia Duster

- Toyota RAV4

- Kia Sportage

- Skoda Kodiaq

- Hyundai Tucson

- Toyota Corolla

- Dacia Sandero

- Volkswagen Passat

- Skoda Superb

- Jetour X50

Unsurprisingly, familiar brands are the most popular. Still, a high number of Jetour sales shows that Moldovan buyers are open to trying newer brands as well.

There’s another factor to keep in mind when choosing what cars to stock in your dealership.

According to Moldova1, more and more buyers are choosing greener options, with more than 9,000 EVs and 73,000 hybrids on the roads.

And when you combine that with the fact that low-emission cars benefit from reduced excise duty, it’s easy to see why adding EVs and hybrids to your stock is a good idea.

Importing a car to Moldova - FAQ

► Can I import cars of any age to Moldova?

Yes, because since 2021, Moldova has lifted its age limit on imported cars.

► What taxes will I pay when importing a car?

You’ll pay three main taxes: customs duty, excise duty, and VAT. The amounts depend on the car’s value, age, and engine size. Electric and hybrid cars benefit from reduced or zero excise duty.

► How can I get a VAT refund after exporting a car from the EU?

You can request your VAT refund once the car has officially left the EU. Track the export using the MRN number and send the seller proof of export (EX-A or CMR). The seller will then refund your VAT deposit.

► Do I need a CMR if I drive the car myself?

No, you only need it if the car is transported by a logistics company.

Importul de vehicule din Europa poate fi un proces complex, dar eCarsTrade este aici pentru a-l simplifica. Aflați cum să: